Guaranteed Lifetime Income: The Secure Way to Fund Retirement

Why Guaranteed Income Matters

Retirement is a time to relax, enjoy your hobbies, pursue new interests, and spend time with loved ones. But it can also be a time of financial uncertainty. Without a source of secure income to help cover living expenses in retirement, you could run out of money before you run out of years.

Guaranteed lifetime income can provide peace of mind that you’ll have funds to support your retirement, no matter how long you live.

Sources Of Guaranteed Lifetime Income

Guaranteed lifetime income is exactly what it sounds like – income that is guaranteed, by the government, an employer, or an insurance company, that continues until your death.

Social Security

A government-administered program that you pay into during your working years, Social Security provides guaranteed income payments based on your earnings history and the age at which you choose to start receiving benefits. Assuming you pay into the system for at least 10 years, you can begin receiving benefits as early as age 62 or wait until the full retirement age of 66 or 67 (depending on when you were born) or later to receive a higher monthly benefit. Social Security payments can increase to keep pace with inflation.

Pension plan

An employer-sponsored plan that guarantees a certain benefit level upon retirement. Pension income is determined by factors like salary, years of service, and retirement age. With pensions, also known as defined-benefit plans, the accounts are funded, invested, and managed by the employer and the amount of benefit they pay is pre-determined. These employer-sponsored pensions are becoming less prevalent as employers move to defined contribution plans that shift investment responsibility and risk to the employee.

Annuities

A financial product offered by insurance companies; annuities are designed to pay guaranteed lifetime income.* With an annuity, you make a lump-sum payment or a series of payments, and in return, the insurance company will provide you with regular income payouts, guaranteed for a specified period or for the rest of your life. Annuities can begin paying income immediately or be deferred for years to allow the value of the account, and future income payouts, to grow. Today, commission-free annuities are available that are less expensive and offer improved benefits over their commissioned predecessors.

Learn more about the basics of annuities and how they work.

How Annuities Deliver Financial Freedom

When considering sources of guaranteed income, think of an annuity as a personal pension that you purchase to provide a steady stream of income payments for as long as you live.

“People may not like the word annuity,” says retirement researcher Wade Pfau, “but when you describe to them what annuities can do, they like them.”

So why consider annuities as a foundation for financial freedom in retirement?

- Peace of mind: People with annuities report being happier and more confident in retirement than people without

- Financial security: Annuities can generate predictable, secure income and will continue making payments even after the account balance goes to zero

- Efficiency: Annuities are the most efficient way to generate retirement income because the same investment amount put into an annuity will result in more income than it would in a bond

- Risk mitigation: Annuities provide asset protection against market volatility and sequence of return risk

What's the Cost of an Annuity?

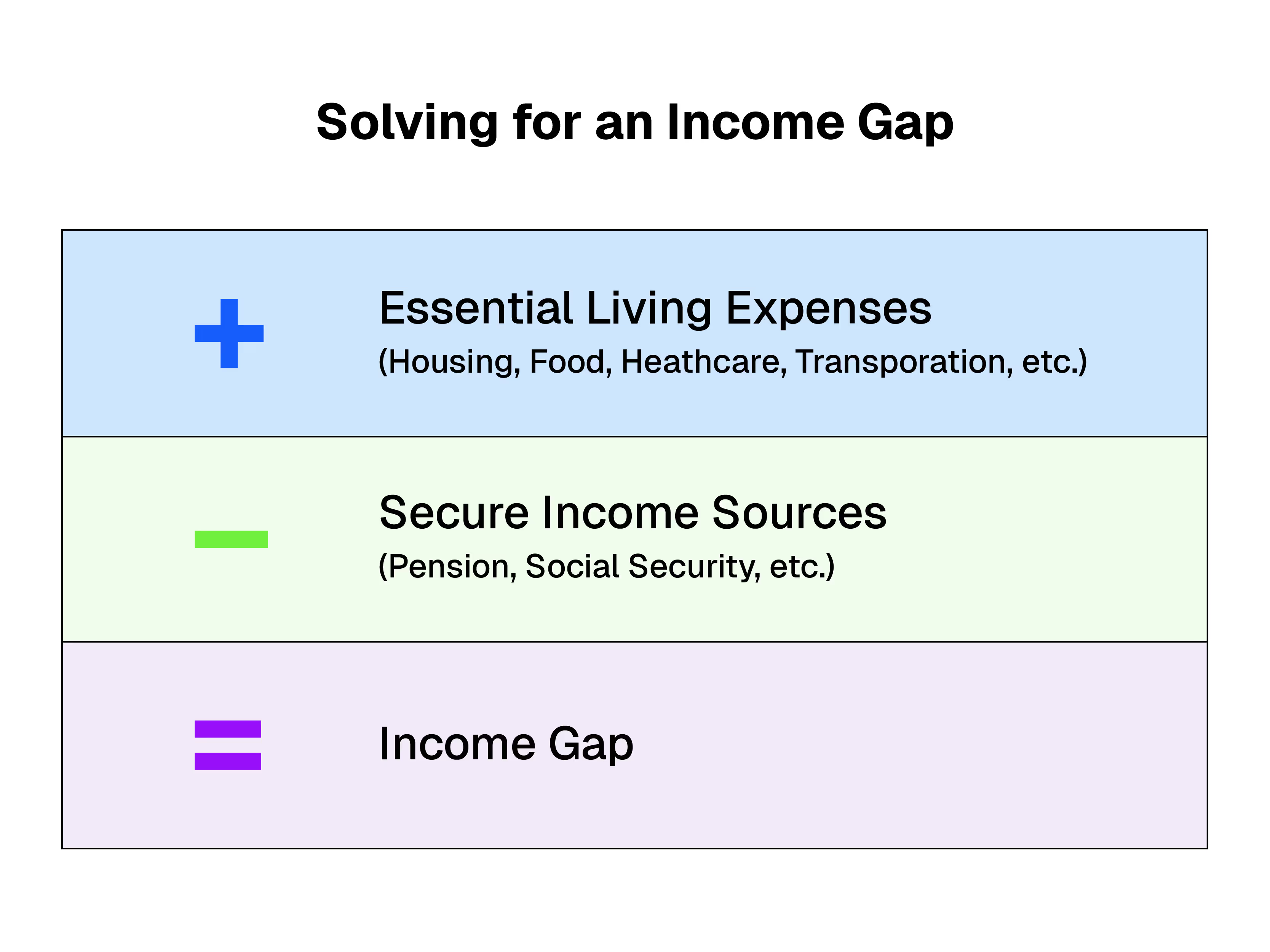

How much you put into the annuity depends on your income needs and the product you choose. When purchasing an annuity to provide retirement income, you can start by determining if you have an “income gap.”

To do this, simply add up your essential living expenses, such as housing, food, healthcare, and transportation, and then subtract the income you’ll receive from secure sources like social security and a pension.

If there is a shortfall, this is your income gap; annuities often are used to fill this need. To estimate how much it would cost to generate a specific amount of income with an annuity, use the Guaranteed Income calculator at dplfp.com.

Smart Ways to Fund an Annuity

There are two primary ways to fund an annuity, either with “qualified” (pre-tax) dollars, like a 401k rollover or IRA transfer, or “non-qualified” (after-tax) dollars, like cash or other investment assets.

How you fund an annuity will have tax implications, so consult with a tax advisor to understand the details before you make a purchase.

Another way to fund an annuity is by exchanging an annuity or life insurance policy you already own for an annuity paying lifetime income through a tax-free transfer commonly referred to as a 1035 exchange, when suitable.

You should review your annuity for loss of benefit or surrender charges. Your financial or tax advisor can help you understand the costs and benefits of each type of funding source.

"Retirement-Saving Tip: A 1035 exchange can fund your annuity tax-free.”

Ask your advisor to compare costs and benefits.

Learn about using annuities in a financial plan.

The benefit of guaranteed lifetime income is the assurance that you will have a predictable and secure income to fund your expenses in retirement, no matter how long you live.

By combining income from guaranteed sources such as Social Security, a pension, and/or an annuity, you can create an income stream to cover your essential living expenses in retirement without worrying about the impact of market volatility on your income.

When evaluating an annuity for guaranteed lifetime income, take into consideration your personal circumstances, risk tolerance, and financial goals to find the product and features that meet your needs.

DPL has several tools to help you learn more about commission-free annuities and see how these solutions fit in a retirement portfolio. We can help.

[press-a-contact-location]

1 Alliance for Lifetime Income Protected Retirement Income & Planning (PRIP) Study

.avif)