Planning for Long-Term Care: Common Questions Answered

Around age 50, many people are completing the pre-flight checklist for retirement. One of the items always at or near the top of the list is healthcare.

While Medicare pays a variety of healthcare costs after age 65, many people don’t realize that Medicare does not pay for long-term care (LTC).1 Having a plan to cover long-term personal care in the event you need it is important to ensuring you and your retirement assets are protected.

What is Long-Term Care?

About 7 in 10 people who live to age 65 will need LTC.2

In general, LTC helps people who can no longer manage some everyday activities – walking, bathing, dressing, among others – continue to live independently and safely. It can also include:

- In-home assistance

- Community programs (like adult daycare)

- Assisted living facilities

- Nursing homes

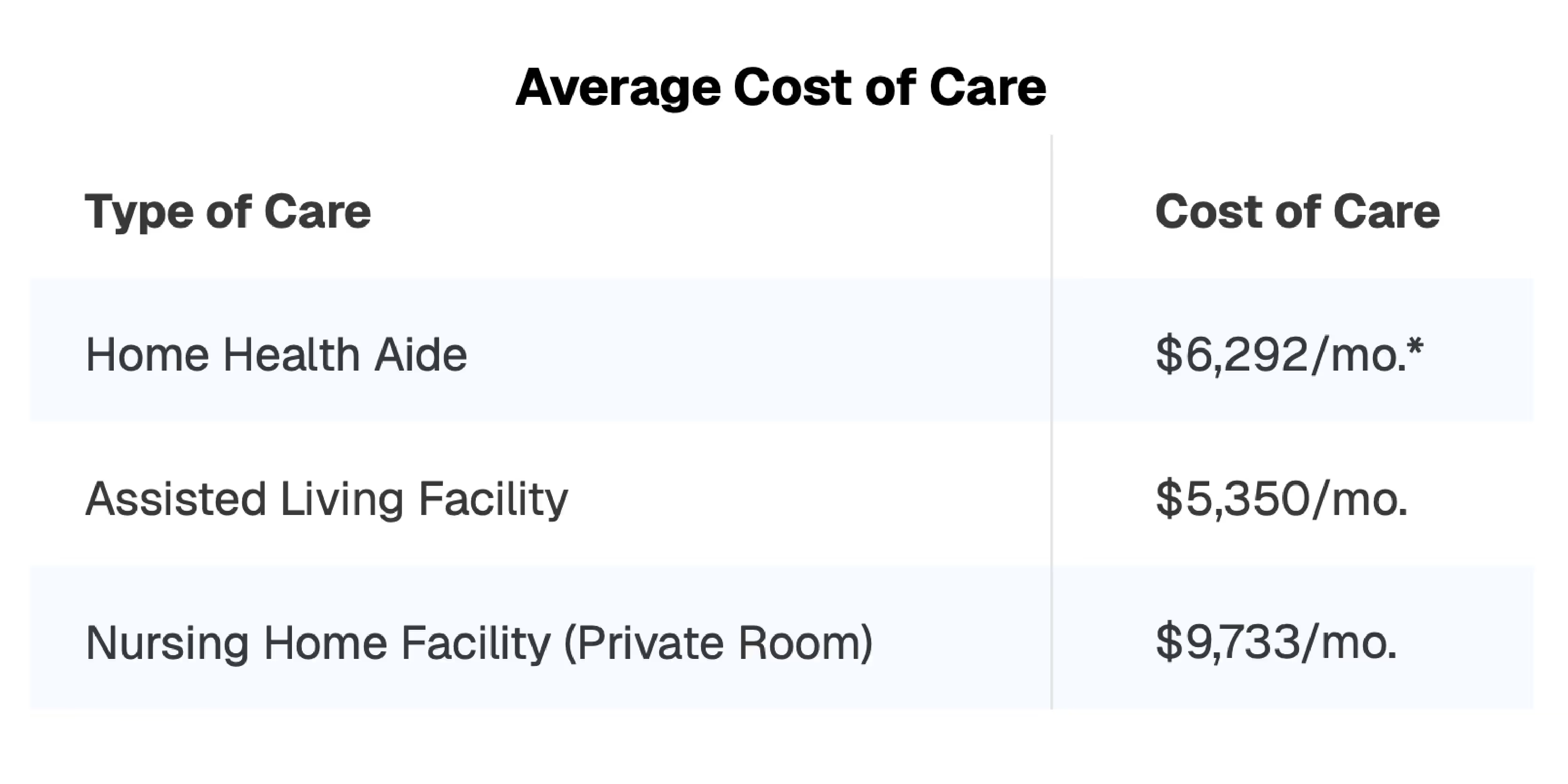

How much does long-term care cost?

The cost of services depends on what care is provided and where. On average, people needing LTC require two to four years, but about 20% need care for more than five years.2

Broadly speaking, the cost can range from $24,000 to $120,000 per year. For example, care that is provided:

- At home, by an in-home care provider, may cost $5,000 to $6,000/month.3

- Through a community program, such as an adult daycare program, may cost about $2,000/month.3

- In an assisted-living facility may cost about $5,000/month, on average.3

- In a skilled nursing facility may cost about $8,000 to $10,000/month.3

“LTC costs can range from $24,000 to $120,000 annually — planning ahead helps protect retirement assets”

How do people pay for long-term care?

While not everyone will need LTC, everyone should think about how they would pay for it if they do. Here are the most common options:

- Personal savings. Some Americans will have accumulated enough wealth to pay the costs of LTC directly

- LTC insurance, hybrid-insurance or annuities. People who have accumulated significant savings for retirement and want to protect their savings for themselves and their spouse may choose to purchase an insurance policy or annuity that will help cover the cost of LTC

- Government programs.

- Medicaid is America’s public healthcare program for people with limited financial means, and it covers the cost of LTC for many people. States have independent eligibility rules.4 Typically, a qualified applicant can have assets – cash, bank accounts, real estate and retirement accounts – of about $2,000 or less. The spouse of a Medicaid recipient may keep some assets (about $150,000), a primary residence and a vehicle.5

- The U.S. Department of Veterans Affairs (VA) covers home and community services for all veterans who qualify and are enrolled in the VA program. VA coverage of residential facility and nursing home costs is limited.6

How do I know which option is right for me?

In general, your income, savings and investments, health status, and a few other factors will determine which option – or combination of options – will help you meet your goals.

Here’s what you need to know:

- Traditional LTC insurance helps pay for LTC through reimbursement or indemnity plans. Reimbursement plans require policy owner to submit receipts for payment, and indemnity plans pay a monthly benefit to the policy owner. People who want to purchase traditional LTC insurance must meet strict underwriting standards. The cost of insurance is determined by the applicant’s health and age, and some may not qualify.

- Some whole and universal life policies have LTC options. Policy owners can draw down the insurance policy’s death benefit to pay LTC costs. If the policy owner needs LTC, the policy provides a monthly benefit until the death benefit is exhausted. If LTC is not needed, the beneficiary receives a tax-free payment when the owner dies. If some money is taken out to cover LTC costs, the beneficiary receives a reduced amount. Applicants must qualify, although people who have whole or universal life insurance policies may be able to exchange their current policies for policies with LTC features.

- Hybrid life insurance / LTC policies can offer a death benefit equal to the amount of money the policyowner pays into the contract, though it can also be higher. People who want to purchase hybrid LTC insurance must meet strict underwriting standards.

For people who do not qualify for other options, there are also annuities that have features designed to help offset the cost of LTC, even if they aren’t technically LTC insurance.

Annuities often are included in retirement portfolios because they help protect against market losses, provide opportunities for growth, and deliver guaranteed lifetime income. Pre-retirees may want to consider annuities with multiplier riders. When owners of income-multiplier annuities meet certain criteria related to their ability to complete certain self-care functions, they may receive double their lifetime payment amount for up to five years.

“Tip: Even if you do not qualify for Long-Term Care Insurance, annuities with multiplier riders can provide valuable protection.”

Having a plan in place for long-term care is important to ensuring your retirement plan will meet your future needs and your income will be protected.

[press-a-contact-location]

1 “Long-Term Care.” Medicare.gov

2 “How Much Care Will You Need?” LongTermCare.gov

3 “Cost of Care Survey.” Genworth

4 Priya Chidambaram, Alice Burns. “10 Things About Long-Term Services and Supports.”

5 “Medicaid Eligibility: 2024 Income, Asset & Care Requirements for Nursing Homes & Long-Term Care.” American Council on Aging

6 “Geriatrics and Extended Care.” U.S. Department of Veteran’s Affairs

.avif)